Read our guide on international bank transfer fees to learn about how to save money. How Do TD Canada Trust transfer Fees Compare to Using a Money Transfer Provider?Īlthough the TD Canada Trust foreign currency exchange rates and transfer fees vary depending on the chosen transfer option, considering the high exchange rate mark-ups applied to foreign currency, the overall cost of a TD Canada Trust international transfer appears to be a great deal steeper than what money transfer operators can offer. Visa Direct Transfers: As with TD Global Bank Transfers, fees incurred for this service will depend on transfer details domestic Visa Direct payments will cost $1.50 per transferĪll costs, including TD Canada Trust exchange rates, will be totaled and presented in the final estimate provided by TD Canada Trust, before payment is submitted. TD Global Bank Transfers: The fees incurred for this service will depend on the chosen currency, destination country and transfer amount fees will not exceed a maximum of $25 per transfer Find out more about what to expect from Western Union Money Transfers here Western Union® Money Transfers: TD does not charge any form of transfer fee for this service, but Western Union charges their own fees and uses their own foreign exchange rates. The fee structure applied to TD Canada Trust international transfers is different for each option:

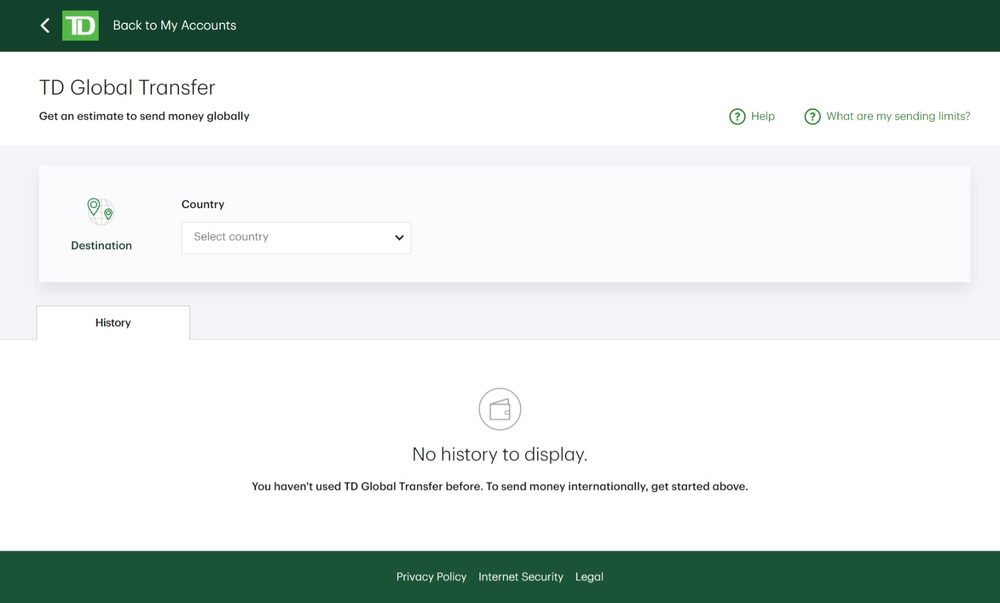

There are some fees applied apart from the exchange rates. Along with its Foreign Exchange Currency Converter tool, the bank also regularly publishes up-to-date foreign currency exchange rates via the Today’s Rates page of the TD Canada Trust website. You can always check the TD Canada Trust exchange rates before making an international money transfer. This is a substantial foreign currency exchange spread and for exotic currencies less commonly traded, the average mark-up can amount to 6%. The exchange rate margin TD Canada Trust and other banks charge for converting foreign currencies is referred to as a mark-up.Īccording to our research, these major currency pairings incur an average mark-up of 3% above the mid-market rate. The most popular currency pairings requested by TD Canada Trust customers are: Customers who bank with TD Canada Trust can enjoy maximum transparency when it comes to foreign currency exchange rates, transfer fees and other costs. Like many banks, when customers want to make an international bank transfer, they should check the exchange rates for foreign currency and the potential bank transfer fees included. For more information about e-transfers read our guide on the subject. Other Ways to Send Money With TD Canada TrustĪs well as multiple types of international transfer options, customers can send domestic wire transfers and Interac e-transfers. Send an international Visa Direct transfer to your recipient's eligible Visa Card Send a TD Global Bank Transfer from your eligible TD Canadian chequing or savings account to your recipient’s bank account Send a Western Union® Money Transfer for cash pick-up Yes, through TD Global Transfer customers can choose from the following three international bank transfer options: TD Canada Trust is a secure, supportive and widely accessible banking option for Canadian customers, but we will be investigating the finer details of their international transfers to see if it is a viable remittance provider.Ĭan I Use TD Canada Trust for International Bank Transfers?

In addition to 1,100 branches and 2,200 “TD Green Machine” ATMs across the country, TD Canada Trust supports online financial services accessible via their EasyWeb online banking platform, and TD Canada mobile app. These include Small Business Banking, Mid-market Commercial Banking, Specialised Commercial Banking and TD Auto Finance Canada. TD Canada Trust is one of the nation’s Big Five banks, and in July 2021, TD Bank Group declared $1.7 trillion CAD in total assets.Īs well as traditional personal banking products, a large part of TD Canada Trust services focuses on business banking products. Not to be confused with TD Bank, this financial institution operates a countrywide network that serves over 13 million Canadian customers, through a range of financial services and solutions including international money transfers and foreign currency exchange services in Canada. TD Canada Trust is the name given to the commercial banking arm of Toronto-Dominion Bank in Canada. In this review we will be assessing whether it is a good idea for users to send money overseas with this bank and what is the TD Canada trust exchange rate. This financial institution is a member of the TD Bank Group and specialises in providing personal and small business banking for customers in Canada.

0 kommentar(er)

0 kommentar(er)